From GDS (Global Distribution System) to an AI-Powered Personal Travel Assistant

Introduction

The travel industry has undergone several revolutionary transformations since the 1960s. From the first CRS (Computerized Reservation System) to today’s mobile booking platforms, each evolution has fundamentally changed how we plan, book, and experience travel. Drawing on my personal journey through this industry—from a young person witnessing travel being booked at a brick-and-mortar agency to my roles at Continental Airlines, OpenSkies, and Navitaire—I want to share this fascinating journey and offer my vision for what comes next: a personalized AI-powered travel assistant powered by an ecosystem centered around what I call “My Travel Data Cube.”

I’ve been fortunate to have a front-row seat to this industry’s transformation. From flipping through thick OAG (Official Airline Guide) printed books in order to write requirements to helping build systems that process millions of bookings daily, the changes have been nothing short of remarkable. But I believe we’re still just scratching the surface of what’s possible.

Key Takeaways

- Travel technology has evolved from mainframe GDS (Global Distribution System) systems to sophisticated mobile platforms, with each transition creating new possibilities for travelers and providers

- Low-cost carriers have consistently led innovation, pushing boundaries that traditional airlines eventually adopted

- Despite technological advances, many travelers still encounter fragmented experiences across their journey

- The next frontier is a personal AI travel assistant powered by a secure data framework that puts control in the traveler’s hands

1960’s- 1970’s: The Birth of Computerized Reservations

The story begins in the 1960s when American Airlines partnered with IBM to develop Sabre (Semi-Automated Business Research Environment). This first-generation system was revolutionary but primitive by today’s standards—massive mainframes with limited capabilities that nevertheless transformed how airlines managed inventory.

- 1960: American Airlines partners with IBM to develop Sabre

- 1964: Sabre becomes operational as the first computerized reservation system

- 1976: Sabre expands beyond American Airlines to travel agents, becoming the first true Global Distribution System (GDS)

I find it amazing to think that these early systems—with less computing power than today’s smartphones—handled the backbone of global air travel for decades.

1980s: The Travel Agency Era

In the mid-1980s, I had my first personal encounter with the travel industry when my parents took my sister to Hunt Travel, a local brick-and-mortar travel agency in Poughkeepsie, New York, to book her high school trip to Israel. As a young teenager, I vividly remember browsing through the high-gloss travel brochures showcasing exciting destinations around the world, while my parents consulted with Irene Hunt, the agency owner.

The process was entirely manual yet personal—Irene collected all the details of my sister’s desired itinerary, eventually entered this information into her GDS terminal, and produced paper tickets that were carefully placed in a Hunt Travel ticket folder. This experience, common for that era, represented the standard way most consumers accessed travel services before the digital revolution.

- 1977: Independent agencies like Hunt Travel open their doors, using these new reservation systems to serve local travelers

- 1987: European airlines create Galileo as another major GDS

- 1987: Amadeus is founded by Air France, Iberia, Lufthansa, and SAS as a European GDS alternative

1990s: The Rise of Low-Cost Models and Direct Distribution

In 1996, after completing my undergraduate degree at the University of Utah, I joined Continental Airlines as a reservation agent. Working seasonally as a restaurant cook at ski areas, I was attracted to the airline industry for the flight benefits that would allow me to travel during my off-seasons.

My training introduced me to Continental’s Qik Res system, a rudimentary semi-graphical interface that connected to Continental’s Shares B CRS. I learned the essential skills of airline reservation work: airport codes, availability searches, fare quotes, collecting payment, adding special requests and frequent flyer information, and finalizing passenger name records (PNRs). Later, I advanced to become a reservation agent trainer and team leader, eventually working as a Customer Support supervisor where I handled more complex cases like manually constructing fare calculations to honor historical fares during ticket reissuance or e-ticket revalidation.

This hands-on experience gave me invaluable insight into both the capabilities and limitations of airline reservation systems, as well as a deep understanding of travelers’ needs and frustrations—perspective that would later prove crucial when I joined OpenSkies to develop more advanced solutions.

- 1992: Morris Air transforms from Morris Charter to a scheduled airline

- 1993 Dave Evans wrote MARS (Morris Air Reservation System), the world’s first ticketless airline system.

- 1994: Dave Evans then founded EARS (Evans Airline Information System Inc.) and created the OpenRes later renamed to OpenSkies in order to market this ticketless and multi-currency/multi-language reservation technology to other LCCs around the world.

- 1995: David Neeleman (founder of JetBlue, Azul, and Breeze Airways) joined this airline technology venture. The company became OpenSkies, and eventually Navitaire, which developed the current New Skies reservation system now owned by Amadeus. New Skies reservation system has processed reservations for a billion passengers for the past 3 years and a staggering >10 Billion passengers since the New Skies platform was created.

- 1995-1996: Early airline websites begin offering rudimentary booking capabilities

- 1999: HP acquires Open Skies for $22 million

2000s: Corporate Travel Support Evolves and Direct Online Distribution Takes Off

In 2001, I experienced the corporate travel side of the industry when I joined STSN, a startup installing high-speed internet in major hotel chains like Marriott. My extensive travel across the country was arranged through American Express corporate travel agents—a stark contrast to my previous role booking travel for others.

This gave me firsthand experience as a business traveler during a transitional period: e-tickets had become the norm, itineraries were delivered via email, and my trips included flights, rental cars, and hotels. When flight changes occurred, a quick call to an AMEX travel agent would resolve issues efficiently. This corporate travel model represented a significant evolution from the brick-and-mortar agency experience I had witnessed in the 1980s.

After being laid off from STSN in 2002, I found a position at OpenSkies, the company developing CRS systems for emerging low-cost carriers (LCCs). Initially hired as a system trainer conducting classroom training for LCC airlines from around the globe, my role quickly expanded to include implementation consulting for new airline clients, configuring business rules and helping them upload schedules, fares, and other system configurations. OpenSkies had recently been acquired by Accenture, which was diversifying into business process outsourcing and early SaaS business lines.

It was an exciting time working with innovative startup airlines that were transforming the industry with new business models. The OpenSkies team, led by Dave Evans, evolved the ticketless model that removed much of the complexity inherited from paper tickets, making flight changes and payment collection as simple as modifying the PNR.

I’ll never forget working with one particularly innovative European LCC startup. A no-nonsense senior leader from this German carrier stormed into our training room one afternoon, clearly frustrated with a complex fee and taxes configuration and calculation process. His direct challenge led us to completely redesign that workflow, ultimately creating a solution that every airline client benefited from. Those kinds of real-world confrontations with industry assumptions shaped my approach to product design for years to come.

Working with these pioneering LCCs—unbound by legacy constraints—pushed us to develop streamlined enhancements to meet their evolving business needs. OpenSkies and these airlines were at the cutting edge of creating self-service online booking, check-in, and ancillary support, driving massive percentages of direct bookings.

- 2000-2005: Traditional airlines see direct online bookings grow from 1-5% to 10-20%

- 2000-2005: Low-cost carriers like Southwest and JetBlue achieve 40-50% direct online bookings

- 2006-2010: The gap widens with traditional carriers reaching 25-35% direct bookings while low-cost carriers hit 70-80%

2010s: Digital Transformation and Personalization

As OpenSkies became Navitaire following the Accenture acquisition, I transitioned to business analyst and product manager roles. We enhanced the OpenSkies reservation system and embarked on developing a next-generation platform called New Skies. From 2005-2016, Navitaire’s airline customer base grew from about 8 airlines when I joined to over 60 airlines and several passenger rail companies.

During this period, we collaborated with innovative LCCs that continuously pushed industry boundaries, while legacy carriers scrambled to catch up. JetBlue worked with Navitaire to introduce differentiated seat fees—now ubiquitous across the industry. Ryanair and Virgin Blue (now Virgin Australia) pioneered ancillary revenue from baggage fees based on configurable business rules, with Spirit later expanding this to both checked and carry-on baggage.

Ryanair was particularly aggressive in driving online adoption, implementing a revolutionary approach around 2004-2006 by charging customers a fee to speak with call center agents. This controversial move was part of their strategy to minimize operational costs while incentivizing customers to use digital self-service channels. As their online capabilities expanded, Ryanair dramatically reduced their call center footprint by developing increasingly sophisticated self-service functions—first through their website and later via mobile channels—allowing customers to handle most transactions themselves. This approach enabled them to maintain extremely low base fares by treating voice support as a premium service rather than a cost built into their fare structure.

Frontier and Volaris developed the first discount fare clubs and ancillary bundles available through annual subscriptions. Asian carriers like AirAsia and Indigo introduced innovations necessary for mass air travel in developing markets, including cash payment options at convenience stores. Indian carriers like Indigo and GoAir recognized that distribution through local Indian travel agencies was essential to their success and challenged Navitaire to build out a robust booking API as an integration channel for these local OTAs such as MakeMyTrip.com and others. This allowed these OTAs to take advantage of the full airline retailing and ancillary service capabilities. This highly flexible and capable airline retailing option preceded—and perhaps influenced—the industry’s later adoption of NDC (New Distribution Capability) offer and order capabilities. The Indian carriers were already seeing significant revenue lift from these API integrations with their critical India-based OTA partners long before NDC became an industry standard.

Meanwhile, Brazilian carrier Gol’s needs drove Navitaire to build more robust GDS interfaces to work with the country’s strong travel agency networks. In Australia, Qantas’ launch of Jetstar required enhanced codeshare and interline capabilities.

In Northern Europe, traditional tour operators like Transavia (Amsterdam), Sterling (Denmark), TUI and Hapag Lloyd (Germany), and Thomas Cook (UK) adopted OpenSkies/New Skies to sell scheduled service alongside their tour-focused flights, requiring systems to accommodate both block sales to tour operators and direct consumer sales.

In a significant industry development, Amadeus acquired Navitaire from Accenture in January 2016 for approximately $830 million. This strategic acquisition allowed Amadeus (traditionally strong with full-service carriers through its Altéa PSS) to gain a substantial foothold in the low-cost carrier market where Navitaire was dominant. The transaction represented another phase in the consolidation of travel technology providers and signaled how the distinction between technology for traditional and low-cost carriers was blurring as business models converged.

This period saw the rise of dynamic pricing for both ancillaries and flights, using machine learning to optimize conversion and revenue. NDC (New Distribution Capability) and offer-order models began transforming airline retailing, leading to next-generation systems like Navitaire’s Stratos and New Skies for low-cost carriers, and Amadeus Nevio for full-service airlines—all leveraging AI and cloud technology to enhance customer experiences and unlock new revenue streams.

- 2011-2015: Mobile apps become primary booking channels

- 2015: Amadeus acquires Navitaire from Accenture for $830 million

- 2011-2015: Traditional airlines reach 35-45% direct bookings

- 2016-Present: Traditional carriers achieve 45-55% direct bookings while low-cost carriers dominate with 85-95%

The Vision: “My Travel Data Cube”

My journey through the travel technology landscape—from experiencing Hunt Travel’s brick-and-mortar service as a teenager, to working Continental’s reservation lines, to working with teams that were developing cutting-edge systems at OpenSkies/Navitaire—has given me a unique perspective on where we’ve been and where we need to go.

Despite all the technological advancements I’ve witnessed and played a small part in helping to create, today’s travel experience remains disjointed. We use separate systems for booking flights, hotels, and activities. Support during disruptions is reactive, not proactive. And our valuable travel data is scattered across dozens of services, leading to repetitive data entry and missed opportunities for personalization.

Introducing A Vision for a Personal Travel Data Cube

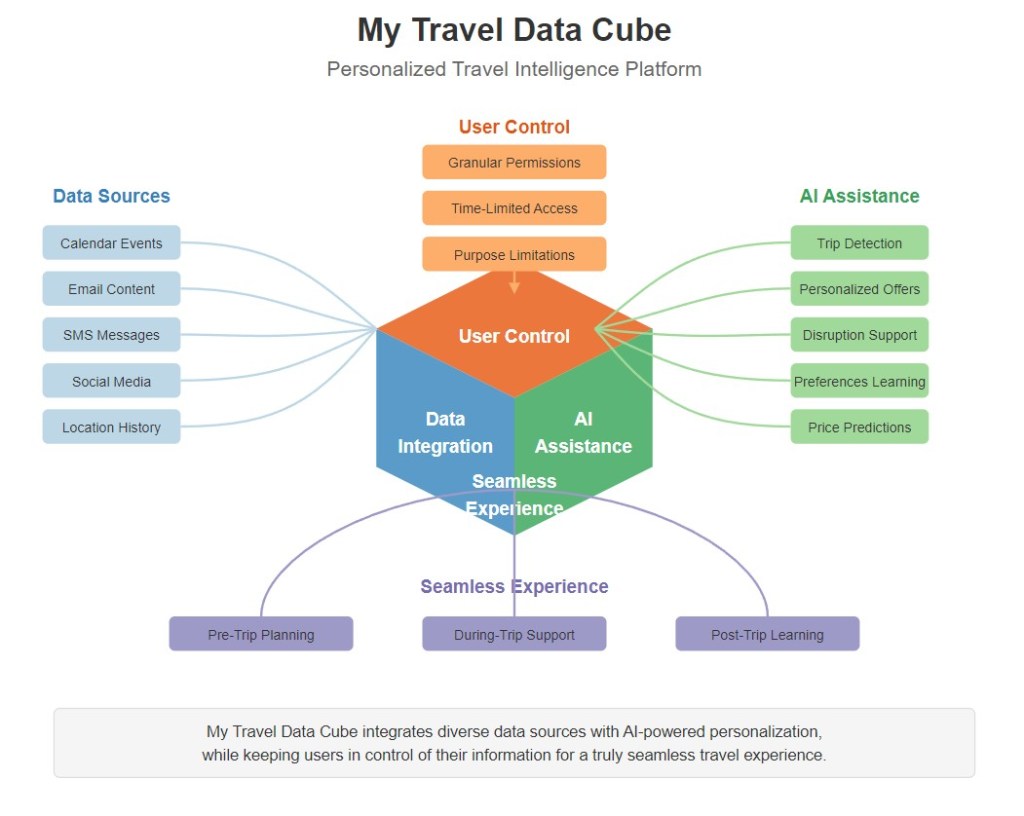

My Travel Data Cube represents a new paradigm—a personalized data abstraction layer that collects, organizes, and securely manages all travel-related data while putting control firmly in the traveler’s hands.

I started sketching this concept on the back of a napkin during a flight from Singapore to LAX in 2023. Earlier in the trip, upon arriving in Singapore, I had fumbled with my phone while watching other travel-weary passengers trying to book their ground transportation via the Uber app after midnight when there was limited capacity of nearby taxis and Uber drivers. I realized how fundamentally broken our current approach to technology remains. Why should each traveler individually struggle to solve the same problem using fragmented tools? Why couldn’t a truly intelligent system anticipate and resolve these issues proactively?

Key elements include:

- Comprehensive Data Integration

- Calendar events suggesting potential trips

- Email and messaging to detect travel intentions

- Location history and past booking data

- Personal preferences across all travel categories

- User-Controlled Data Governance

- Granular permission settings (“share my food preferences but not my full calendar”)

- Time-limited access (“only during this specific trip”)

- Purpose limitations (“only for rebooking disrupted flights, not marketing”)

- AI-Powered Personalization

- Proactive trip suggestions based on calendar events and communications

- Personalized recommendations based on past preferences and price sensitivity

- Seamless rebooking during disruptions based on personal priorities

The Travel Experience Transformed

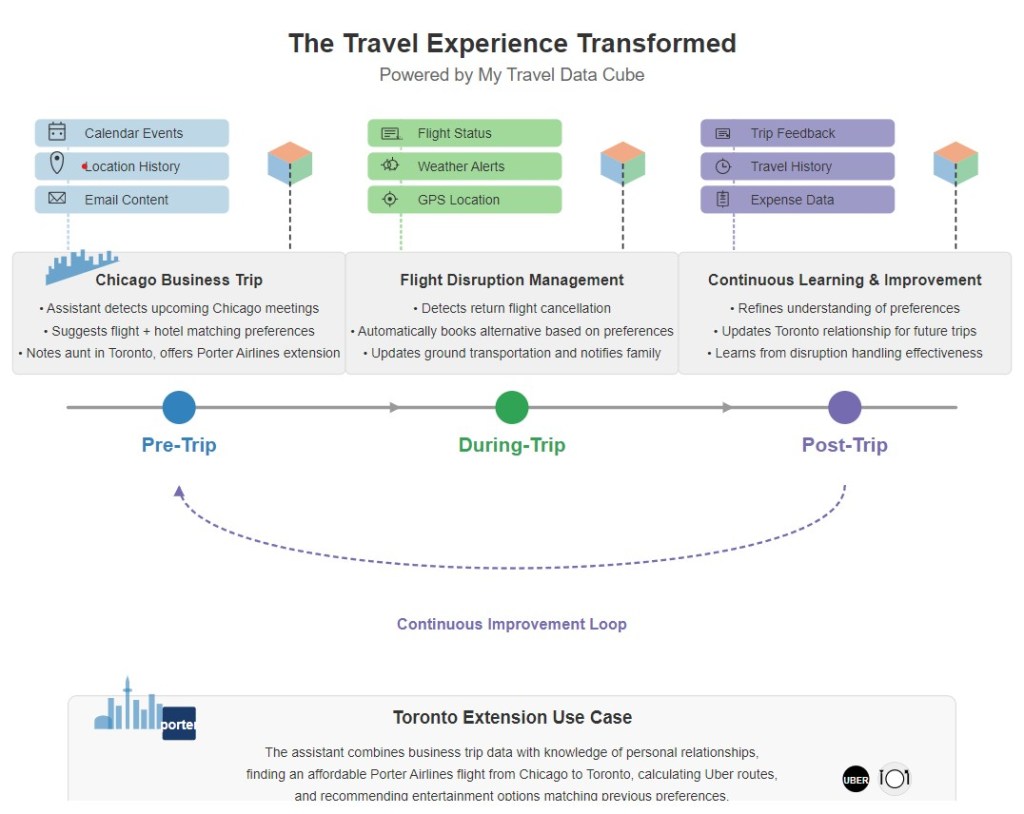

With My Travel Data Cube, the travel experience becomes fundamentally different:

Pre-Trip: The system recognizes I have a potential business trip to Chicago based on calendar invites. It proactively suggests flight options aligned with my preferences (aisle seat, early morning departure) and price tolerance, while also recommending a hotel near my meeting location where I’ve stayed before and rated highly.

Going further, the assistant notices from past communications and location history that I have an aunt in Toronto whom I enjoy visiting. It finds an affordable Porter Airlines flight from Chicago to Billy Bishop Toronto City Airport (downtown Toronto), which would get me just a few miles from my aunt’s home. The system also calculates the optimal Uber route from the airport and, based on my dining and entertainment history, recommends a well-reviewed restaurant and a show that matches my taste in entertainment. These Toronto extension options are added to my trip wishlist for approval and payment, making it effortless to combine business and personal travel.

During Trip: When my return flight is canceled due to weather, the system automatically identifies alternatives based on my priorities, secures a seat, updates my ground transportation, and notifies both my family and my calendar.

Post-Trip: The system learns from each journey, refining its understanding of my preferences and incorporating feedback to improve future recommendations.

The Path Forward

While the technology to enable this vision largely exists today, several challenges must be addressed:

- Trust and Privacy: Creating a secure, transparent framework that gives users confidence in sharing sensitive data.

- Industry Collaboration: Building an ecosystem that works across all travel providers without being captured by any single company’s interests.

- Data Standardization: Establishing protocols that allow seamless data exchange while maintaining security.

I believe this transformation will likely be initiated by technology companies entering the travel space and disrupting established patterns. Eventually, major travel IT players like Amadeus will invest in or acquire these disruptors, integrating their innovations into broader industry infrastructure.

The key to success will be establishing that critical trust relationship that allows travelers to grant access to their personal data in exchange for dramatically improved travel experiences. The company that successfully builds this trusted intermediary layer will become the essential foundation for the next generation of travel technology.

Conclusion

The evolution of travel technology from the first GDS systems to today’s direct booking platforms represents one of the most successful digital transformations in any industry. My personal journey through this landscape—from observing travel agents with physical brochures to helping build sophisticated airline retailing systems—has shown me both how far we’ve come and the exciting possibilities ahead.

My Travel Data Cube vision represents the next frontier—moving beyond fragmented booking tools toward a comprehensive ecosystem that understands the traveler’s full context and needs. By putting data control in consumers’ hands while enabling unprecedented personalization, this approach promises to transform the travel experience once again.

Dare I say this personal AI travel assistant will be a more scalable and personal evolution of the service Irene Hunt offered my parents at Hunt Travel agency back in the 1980s. While technology has advanced dramatically since those days of paper brochures and tickets, the core need remains the same—personalized, thoughtful travel assistance that understands your needs and preferences.

The industry will surely face challenges implementing this vision. Questions about data ownership, privacy regulations, and competitive concerns will need resolution. There’s also the significant hurdle of convincing diverse travel providers to participate and implement compatible solutions – getting airlines, hotels, ground transportation companies, and activity providers to adopt a unified approach across their disparate systems would be no small feat for a vision with such an audacious scope. But the potential benefits—both for travelers and providers—are too significant to ignore.

The future of travel technology isn’t just about better booking interfaces or faster systems—it’s about creating a truly intelligent travel companion that understands you, anticipates your needs, and makes travel dramatically more seamless and enjoyable.

About the Author

Seth Horowitz has over 20 years of experience in travel technology, starting as a Continental Airlines reservation agent and progressing to senior product roles at OpenSkies/Navitaire. Throughout his career, he has helped develop reservation systems used by 60+ global airlines and has been involved in numerous innovations that transformed how airlines sell travel and interact with customers. Seth currently provides consulting services to airlines and travel technology companies.

Feel free to email Seth at skisushi@gmail.com if you would like to engage in further discussion on this or any other topic.

Note: This research and editing process utilized Claude 3.7 Sonnet, a hybrid reasoning AI model from Anthropic, to aid in researching industry historical facts, editing for spelling, grammar, flow, generating images and making recommendations to the author related to flow and engaging content , leveraging its ability for both rapid responses and extended, step-by-step thinking

Seth,

Thoroughly enjoyed your travel evolution article, very insightful!

The rush to book uber after the plane lands just so you can avoid the uber surge price. Still a lot of opportunities to improve indeed.